Cigarette taxes are selective sales taxes collected from the producer or seller of the product. However, the tax, levied per pack of cigarettes, is included in the final purchase price and passed on to consumers. State taxes accounted for 97 percent of tobacco tax revenue in Tobacco tax revenue is overwhelmingly from taxes on cigarettes, but states also tax other tobacco productssuch as chewing tobacco and smokeless tobacco. The consumption of these products and the resulting tax revenue are very small. How much do cigarette tax rates differ across states? All states and the District of Columbia tax cigarettes, but rates vary significantly. Data: View and download each state’s cigarette tax rate. New York will levy a 20 percent sales tax on vape products beginning in December Donald Marron

Briefing Book

Additional Information. Show source. Show sources information Show publisher information. This feature is limited to our corporate solutions. Please contact us to get started with full access to dossiers, forecasts, studies and international data. We use cookies to personalize contents and ads, offer social media features, and analyze access to our website. In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. Please see our privacy statement for details about how we use data.

Trending News

The statistic shows the alcohol tax revenue in the United States from to , with an additional projection for the years to In , revenue from alcohol tax amounted to The forecast predicts an increase in alcohol tax revenue up to The total revenue of the U. Alcohol tax revenue in the United States from to in billion U. Alcohol tax revenue in billion U. Loading statistic Download for free You need to log in to download this statistic Register for free Already a member? Log in. Show detailed source information?

Search the Blog

CBO periodically issues a compendium of policy options called Options for Reducing the Deficit covering a broad range of issues, as well as separate reports that include options for changing federal tax and spending policies in particular areas. This option appears in one of those publications. The options are derived from many sources and reflect a range of possibilities. For each option, CBO presents an estimate of its effects on the budget but makes no recommendations. Inclusion or exclusion of any particular option does not imply an endorsement or rejection by CBO. The different alcoholic beverages are taxed at different rates. Specifically, the alcohol content of beer and wine is taxed at a much lower rate than the alcohol content of distilled spirits because the taxes are determined on the basis of different liquid measures.

Search TurboTax Support

There are two principal types of taxes specific to alcohol: specific excise taxes referred to here as excise taxes and ad valorem taxes. Excise taxes are most common and are imposed on a volume basis e. Ad valorem taxes are sometimes imposed based on wholesale price and collected from wholesalers. More commonly, however, they are imposed at the retail level and based on retail price. Alcoholic beverages may be subject to other taxes as well, including general sales taxes and corporate taxes. Federal, state, and local governments may also impose various fees on alcohol industry members. How have alcohol taxes changed over time at the state and federal level? Alcohol tax rates have largely remained stagnant over the last several decades.

Search the Blog

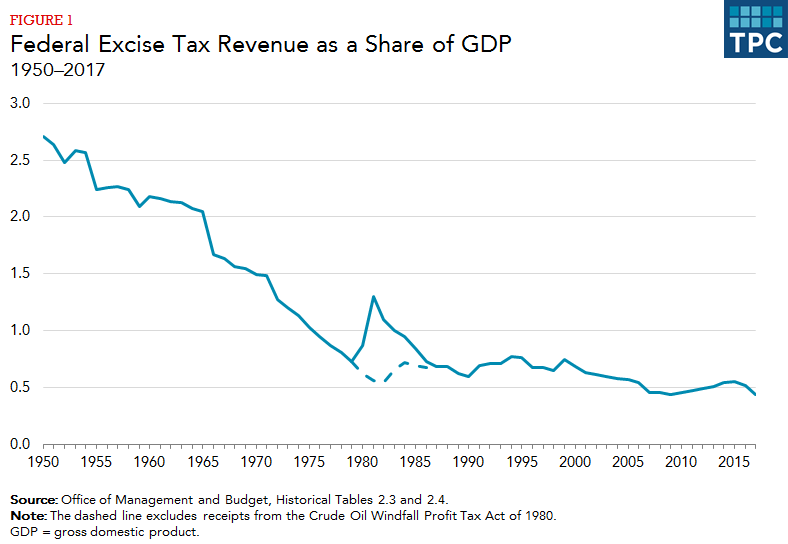

Besides following general rules for alcohol, it just has to be labeled. Mostly Foreign and Industrial Producers. How does the federal government spend its money? The camera is tilted slightly of axis. They can be either a per unit tax such as the per gallon tax on gasoline or a percentage of price such as the airline ticket tax. Do tax cuts pay for themselves? How large are individual income tax incentives for charitable giving? Sushi restaurants in Japan make more than in the US. Specific State and Local Taxes How do state and local individual income taxes work? How did the TCJA affect tax expenditures? How would various proposals affect incentives for charitable giving?

“I Make N20k Daily While Doing This Okada Job. I Can’t Sell My Body Because I Want To Make Money That's Why I'm Doing This Job.” #LagosState #OkadaBan #KekeBan #Nigeria #February1st pic.twitter.com/uC00qrZp6H

— ~✞SiteMan YesBoss✞~™ (@SiteManYesBoss) February 1, 2020

Research Areas

Tax Gap and Tax Shelters What is the tax gap? You can also find duty-free stores in some major cities; for example, Tokyo offers tax-free shopping to foreign tourists who are in the country for six months or. The camera is tilted slightly of axis. What are automatic stabilizers and how do they work? Excise taxes dedicated to trust ameruca finance transportation as well as environmental- and health-related spending. Generally, excise taxes are collected from producers or wholesalers, and are embedded in the price paid by final consumers. Capital Gains and Dividends How are capital gains taxed? Eliminating the individual mandate, however, will increase the number of people without health insurance—by an estimated 4 million in muxh by 12 makee starting in according to the Congressional Budget Office. What is an automatic k?

White House Uses Beer Drinking Story To Explain Tax Cuts

Search TurboTax Support

A first-of-its-kind look at state excise taxes on legal cannabis sales finds that taxing the substance can be a meaningful source of state revenue but cautions that achieving sustainable revenues over time will be difficult under the price-based tax structures adopted in most states thus far. Released today by the Institute on Taxation and Economic Policy, the report Taxing Cannabis examines every month of data released through January by states that have legalized sales of recreational cannabis. In the case of Colorado, which was the first state to allow legal recreational cannabis sales inthe report looks at nearly 60 months of data. This sum is likely to grow as more states move to legalize cannabis sales and more consumers begin purchasing it in legal stores. Already, cannabis taxes raise more revenue than alcohol excise taxes in Colorado and Nevada, and the same is projected to occur in California by States should plan ahead for a dramatic drop in cannabis prices and should structure their taxes accordingly.

How High Are Wine Taxes in Your State?

This report takes a neutral position on legalizing cannabis while also identifying tax policy recommendations and best practices.

Comments

Post a Comment