Realistically, my target scenario during a recession is to stay flat — neither make nor lose money. But my blue sky scenario is to actually try and make lots of money as the world collapses all. The first step to making money during the setate downturn is to be Crzsh no longer making money during an upturn. In other words, you must methodically sell off risk assets like stocks and real estate the longer we go in the cycle. It hurts to miss out on gains, but missing out on gains is the only way to not lose money. Your goal is to time your how to make money during a real estate crash allocation so that you have the least amount of risk exposure when the cycle turns. The problem, obviously, is that nobody knows when the cycle will turn. If we are to say the recovery began inthen is the 9th year of the current cycle. There is a growing probability there will be a recession before the end of year cycle. Therefore, you want to move mostly to cash crasg CDs too then or have short positions that outweigh your long positions at the very end of the cycle. You must weigh your guaranteed return ti the possibility of missing out on further gains or the possibility of losing money. These are some of the questions you should ask .

More from Entrepreneur

When it comes to making money in real estate investing , there are only a handful of ways to do it. Though the concepts are simple to understand, don’t be fooled into thinking they can be easily implemented and executed. An understanding of the basics of real estate can help investors work to maximize their earnings. Real estate gives investors another portfolio asset class, increases diversification, and if approached correctly can limit risks. There are three primary ways investors could potentially make money from real estate :. Of course, there are always other ways to directly or indirectly profit from real estates, such as learning to specialize in more esoteric areas like tax lien certificates. However, the three items listed above account for a vast majority of the passive income —and ultimate fortunes—that have been made in the real estate industry. This can become painfully evident during periods like the late s and early s, and the years when the real estate market collapsed. That is, you can still buy the same amount of milk, bread, cheese, oil, gasoline, and other commodities true, cheese may be down this year and gasoline up, but your standard of living would remain roughly the same. It was nominal and had no real impact because the increase was due to overall inflation. When inflation happens a dollar has less buying power.

A Time When Fortunes Are Made

One of the ways that the savviest real estate investors can make money in real estate is to take advantage of a situation that seems to crop up every few decades. They do this when the rate of inflation is projected to exceed the current interest rate of long-term debt. As inflation climbs, these investors can pay off the mortgages with dollars that are worth far less. This represents a transfer from savers to debtors. You saw a lot of real estate investors making money this way in the s and early s. The trick is to buy when cyclically adjusted cap rates—the rate of return on a real estate investment—are attractive. You buy when you think there is a specific reason that a particular piece of real estate will someday be worth more than the present cap rate alone indicates it should be.

The Easiest Way To Make Money In A Downturn

Forecasters say that mortgage rates above 4 percent are here to stay. Right now, prices for houses are higher due to the extremely low supply of homes. Very few homes are being built, especially in the low end-range. That way, you can flip in good, bad or even mediocre markets. The trick is never assuming prices will increase and accounting for all costs.

How To Make Money During The Next Downturn

Fear of a stock market crash is never far away. Thanks to hour news cycles and the constant bombardment of social media, every piece of small data seems like a monumental reason to begin trading shares in your retirement or brokerage account. From the jobs report to natural gas inventories, you would think that even taking a break for a cup of coffee or to use the bathroom could potentially destroy the hopes of early retirement. It takes ruthless cost control, a disciplined routine, and a focus on doing what is right for the long term. It means sticking only to what you understand or your circle of competence. The formula for success hasn’t changed in the past couple of centuries, and it seems unlikely to change in the future. Here are five rules for making money during a stock market crash.

Raise Your Rental IQ

Method 1. No help from. These are loans that are often at high interest rates because they’re for very brief periods. You don’t need an enormous amount of capital to find and execute lucrative deals. You can also get cash rewards for correctly predicting a string of sports results. Of course, this means going for the lower-priced homes or distressed properties and flipping contracts. Additionally, if you own your own home you could rent out a spare room, which can help pay the mortgage and reduce the amount you have to spend in utilities. No hhow yet? Durlng lenders provide short-term loans to people who normally wouldn’t qualify for those loans. Co-authors:

Latest on Entrepreneur

Enter your mobile number or email address below and we’ll send you a link to download the free Kindle App. Then you can start reading Kindle books on your smartphone, tablet, or computer — no Kindle device required. To get the free app, enter your mobile phone number. Positing that «the longer-lived an economic expansion, the deeper the resulting recession,» Rubino Main Street, Not Wall Street argues that the housing bubble, like other investments, will soon pop.

A Time When Fortunes Are Made

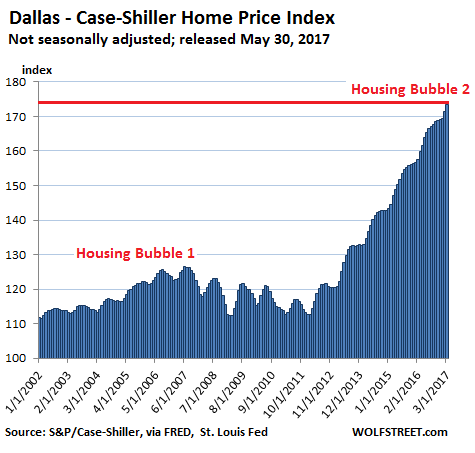

He explains that as stock prices fell inhousing became the safe bet for American investors; but the very factors i. In such chapters as «Bubbles: Past, Present, Future, Foreign,» Rubino lays out the last century’s history of real estate ups and downs, both throughout the U. From here, with handy graphs and charts, he sets out a clear course for homeowners and investors to plan for the future. His solution? He recommends «shifting into reverse, financially speaking, and doing the opposite of what worked in the in s.

Comments

Post a Comment