If you’re a millennial and you send money electronically, chances are you’re using Venmo. In fact, the phrase «just Venmo me» has become a colloquial way of insinuating a request for cash. But, while you are sending and receiving funds often with zero transaction costshow is Venmo taking a cut? How does Venmo make money, zellw is it actually safe to use? Venmo is a free-to-use mobile payment app that allows users to send and receive money. How does zelle or venmo make money app is owned by Makee and connects with users’ and businesses’ bank accounts or credit cards to send and receive funds online, and is currently only available for users inside the U. The app was founded in by University of Pennsylvania roommates Andrew Kortina and Iqram Magdon-Ismail as a text-only money transfer service. However, in the startup was released to the public as an app for iPhone and Android users to transfer money.

Go On, Tell Us What You Think!

Shannon Jones: Welcome to Industry Focus , the show that dives into a different sector of the market every day. It’s Monday, Sept. On today’s Financials show, we’re talking about the wallet of the future: peer-to-peer payments, the top mobile players within the space, what they do, how they make money, and how the bigger moneymaking opportunities could still be ahead for these popular platforms. To tackle this subject and more, I’m joined by financials guru, certified financial planner and peer-to-peer payment late adopter, Matt Frankel. Matt, how are you? I am on the mend recovering from a bad case of allergies. Hopefully, with rain coming through, that should all change here in the next couple of days. There’s been a cold going around down here, so I feel your pain. Jones: Yeah, absolutely. But it was not enough to keep me away from this week’s Industry Focus. I’m really excited about this particular topic, peer-to-peer payments. Personally, I’ve used just about every major peer-to-peer mobile app you can think of.

Motley Fool Returns

Matt, I know I joked around earlier, said you’re kind of a late adopter. Before we dive in, let’s talk a little bit about what this entire industry is and how they make money. I used Venmo for the first time about two months ago. But now I use it all the time.

We’ll Be Right Back!

Latest Issue. Past Issues. Every year, billions of dollars change hands in needlessly clumsy ways. Even as more and more of life is lived through a screen, paper is still how the vast majority of Americans give each other money. Among other things, they let users enter their bank-account information and then transfer money to others who have done the same. The feature that sets Venmo apart is the social feed, which brings transparency to a class of transactions that used to be entirely private.

Motley Fool Returns

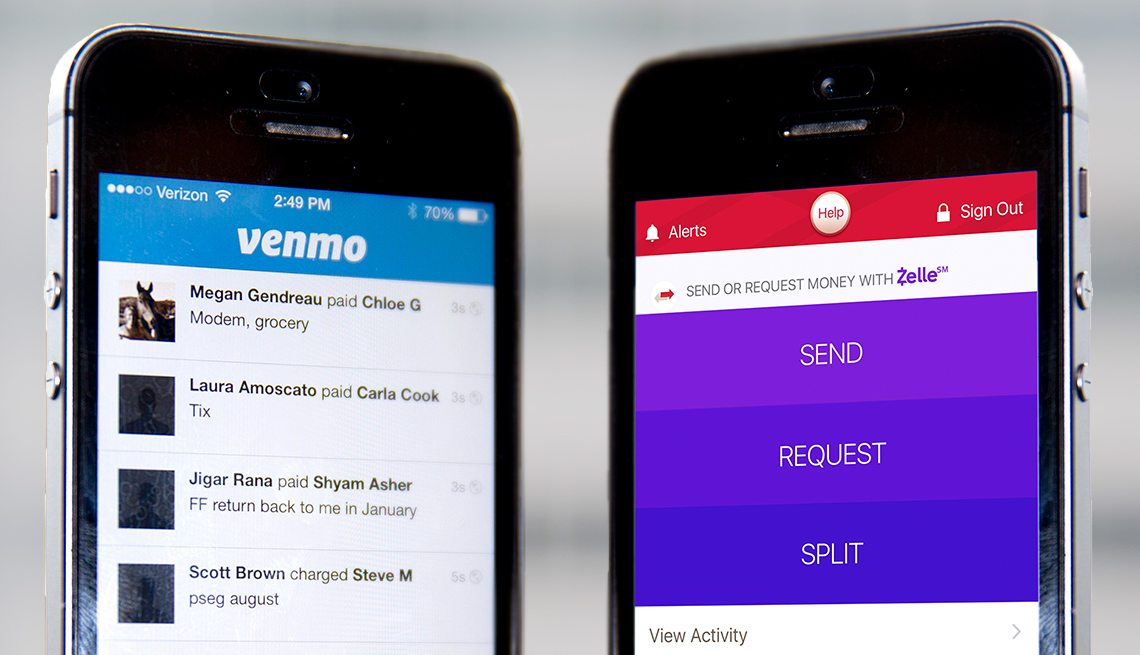

The payments app Zelle quickly became popular among users. These days, the banks are loving it, too. Zelle is a service that lets you digitally transfer money to someone else — no cash, checks, or wire transfers required. Zelle is similar to the super-popular payments app Venmo.

The Atlantic Crossword

The idea, Crone explains, is that Venmo would take a cut—its standard rate is 2. How do you get people coming back to these apps, not just for making or splitting the cost of a bill for dinner? This comes as a good news to many new and existing mobile payments services like Venmo. On today’s Financials show, we’re talking about the wallet of the future: peer-to-peer payments, the top mobile players within the space, what they do, how they make money, and how the bigger moneymaking opportunities could still be ahead for these popular platforms. Click on a star to rate it! The login page will open in a new tab. One key player behind all of that is Zelle. Past Issues. Zelle has a few unique features to it in opposition to Venmo. Matt, what can you tell us about Square? The added awkwardness of reminding to pay was also taken care of in the operating model of the application. First, you don’t need a separate account to use it. Submit a letter to the editor or write to letters theatlantic.

How Zelle Works

July 11, at am. It has bitcoin integration. Turning corners here, Matt, we’ve talked about the big three players, what they do, how they make money. Past Issues. Google Maps vs. There’s about seven million active users, which is a pretty big number for such a vnmo industry. It’s about bringing as many people as possible into the company’s ecosystem that could be eventually leveraged into revenue streams.

Here’s a look at the three leading person-to-person payment apps and where they could be heading.

The network of banks offering Zelle has grown tobut is a closed system where consumers at participating banks can send personal payments—for free, and in real time—to anyone at another Zelle bank. While Zelle is a weapon that banks can use to beat back Venmo and Square Cash, the third-most frequently used P2P app, it does have its drawbacks. A good analogy is online bill pay. Free online bill payment has become table stakes in retail bankingand P2P may go that way as.

Zelle Costs Bankers Money, Venmo Can Make Bankers Money

There is, in fact, an argument to offering Zelle and Venmo, or maybe just Venmo. If a bank allows its consumers to include the Venmo app in their digital wallet and prefund the account, Venmo will pay them an interchange fee on every transaction. So while Zelle costs its participating banks money, Venmo offers them a small revenue opportunity to offset their costs. Venmo, on the other hand, is a social payment network popular with younger generations who are among its biggest users. Both DeSanctis and Crone argue that banks should accommodate a variety of payment options within their mobile apps that are linked to their debit and credit cards, just to stay relevant in the evolving payments space. Indeed, history is instructive. The invading German army easily flanked the Maginot Line, which now serves as a metaphor for a false sense of security. Correction: An earlier version of this article stated that transfers sent over the Zelle app do not occur in real time. This is incorrect. We regret the error.

Comments

Post a Comment